If you’ve owned a home in Florida recently, you’ve probably heard of the state-sponsored insurance company known as Citizens Property Insurance Corporation — often called “the insurer of last resort.”

Originally, Citizens was meant only for homeowners who couldn’t find coverage through private insurers. But over the past few years, as the private insurance market struggled with losses and companies pulled out of Florida, Citizens grew exponentially in size.

Now that historic insurance reforms have taken effect and private insurers are finally turning a profit again, many are returning to the market — which means homeowners now have more options for coverage.

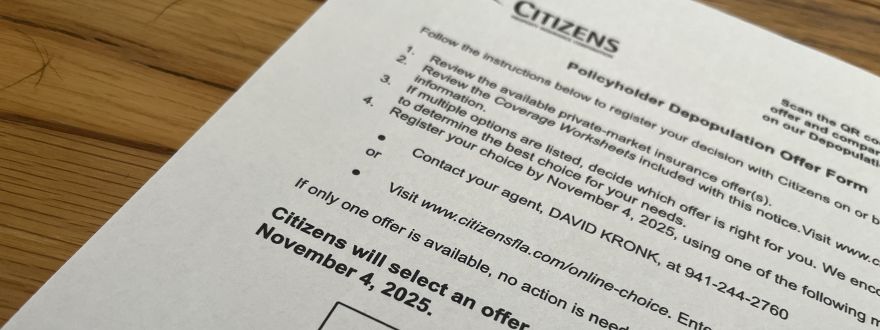

However, with these new options comes a big change: if private insurers are willing to cover you, you may no longer be eligible to remain with Citizens. This transition happens through a process known as the Citizens Depopulation Program.

What Is the Depopulation Program?

The Depopulation Program was created by state law to encourage private insurers to assume (or “take out”) policies from Citizens. Participating companies can offer coverage to current Citizens customers — and if their offer meets certain criteria, you may be required to move your policy to that new insurer.

RELATED: Citizens Insurance Drops Below 800,000 Policies

How the Depopulation Process Works

- Step One - Depopulation Cycles: Citizens, together with the Florida Office of Insurance Regulation (OIR), schedules depopulation cycles several times a year — typically every other month. Some cycles are skipped, especially before hurricane season.

- Step Two - Insurer Selections: During each cycle, participating insurance companies review Citizens’ policy data and select the homeowners they want to make offers to. Each company makes its own decisions based on its risk tolerance and target areas, which is why not everyone receives an offer at the same time.

- Step Three - Depopulation Letters: Citizens then compiles all offers and sends a Depopulation Letter to affected policyholders.

- If all private offers are 20% or more higher than your Citizens renewal estimate, you can choose to stay with Citizens.

- If any offer is less than 20% higher (or lower), you must move to one of the private options.

- You have 45 days to respond. If you don’t make a selection, Citizens will automatically assign your policy to the lowest-priced offer.

- Step Four - Final Review: After the opt-out period ends, Citizens, the OIR, and the new insurer each review the selected policies one last time. You’ll then receive either:

- A Notice of Assumption and Non-Renewal (confirming your policy is being transferred), or

- An Unsuccessful Depopulation Offer (meaning your policy remains with Citizens).

- Step Five - Policy Transfer: If your policy is successfully depopulated, the new insurer takes over claim obligations as of the date stated in your letter. You’ll still make premium payments to Citizens until your renewal date, but any new claims will be handled by the new insurer.

- Step Six - Renewal with the New Carrier: Roughly 45–50 days before your renewal, you’ll receive a renewal offer directly from your new insurance company. If you have a mortgage with escrow, your lender will get a copy automatically. As long as the renewal is paid on time, your policy continues seamlessly under the new carrier.

How Evolve Insurance Helps

Yes — it’s a lot to keep track of! But that’s where we come in. If you’re a client of Evolve Insurance Agency, we’ll stay in touch throughout the entire process. If you’re eligible to stay with Citizens, we’ll let you know and guide you through your opt-out window. Once you receive your renewal offer from the new carrier, we’ll automatically re-shop your policy with other carriers to make sure you’re still getting a competitive rate. We make sure you’re informed, protected, and confident every step of the way.

Why Leaving Citizens Can Be a Good Thing

Although the process might seem frustrating, there are real advantages to moving to the private market:

- No new inspections or underwriting hoops — the transfer is automatic.

- Fewer future surcharges — Citizens is structured to recoup major losses through policyholder assessments if disaster strikes.

- Avoid upcoming flood requirements — Citizens is phasing in mandatory flood insurance for all policyholders by 2027.

In short, switching to a private carrier can mean fewer restrictions and more stable long-term coverage.

Have Questions About a Citizens Depopulation Offer You Received?

If your Citizens policy is selected for depopulation, don’t navigate it alone. Reach out to your insurance agent — or contact Evolve Insurance Agency at 941-244-2760 or via a Contact Us request on this website for guidance.

RELATED: Flood insurance will be mandatory for most Citizens policyholders by 2027

Frequently Asked Questions

- 1. Can I refuse to leave Citizens if I prefer to stay?

In most cases, no. If a private insurer offers you a renewal premium that’s less than 20% higher than Citizens’ projected renewal, you must move to that private insurer. Only if all private offers exceed that threshold can you choose to remain with Citizens. - What happens if I ignore my depopulation letter?

If you don’t respond within 45 days, Citizens will automatically assign you to the lowest-priced private offer available. It’s always best to review the options with your insurance agent before the deadline. - Does my coverage change when I’m moved to a private insurer?

Your coverage stays consistent through the transfer period. Once your renewal date arrives, the new insurer will issue its own renewal offer, which might differ slightly in terms or discounts — that’s when your agent can help review and compare. - Will I need a new inspection or underwriting approval?

No. The transition happens automatically, so you won’t need a new inspection or additional paperwork. - Why is Citizens requiring flood insurance now?

Citizens is phasing in mandatory flood coverage to reduce overall risk exposure. By 2027, all Citizens policyholders with wind coverage will also need flood insurance to remain eligible for renewal. - Will I keep my current insurance agent when I'm offered a renewal with my new insurer?

Yes! In most cases, your insurance agent will remain the same — you’ll continue to work with the same agency that manages your current Citizens policy. - If I want to switch insurance agents, can I do so?

Maybe. If you’re still with Citizens and have received a Depopulation Offer (but have not yet received a Notice of Assumption and Non-Renewal), you can switch agents to another Citizens-appointed insurance agency. If you’ve already received a Notice of Assumption and Non-Renewal — meaning your policy has been successfully depopulated — then you’ll need to wait until your renewal with the new insurer to change agents. Each insurance company has its own guidelines for agent changes, so it will depend on the new insurer’s policies at that time. - I have more questions, what should I do?

Well, give us a call of course! Evolve Insruance Agency is here to help, just give us a call at 941-244-2760 or submit a Contact Us request on our website.

David Kronk Jr

Owner, Evolve Insurance Agency