It’s no secret that new homes are being built at record speed in Venice, FL and the surrounding areas. If you are thinking about building or purchasing a brand new home, we’re going to go over a few tips you can keep in mind to keep the cost of your insurance down. Depending on how long you plan on owning the home, the savings can really start to add up as the years go by! With so much focus on a customer’s mortgage interest rate, there’s usually little time to spare when thinking about homeowners’ insurance – which can easily be one of the largest expenses to consider when owning a home! So what can you do to keep your insurance costs down as you prepare to design and build that dream home of yours?

RELATED: There's never been such a severe shortage of homes in the U.S. Here's why

Construction Type – Masonry is best!

If you are in the beginning stages of the home’s design process, we would recommend you choose to build the home using old-fashioned concrete block. When you use concrete block to build the exterior walls of the home, your home will be rated as “Masonry” construction. If your home is a mixture of part frame and part masonry, then the rule of thumb is as follows: The Masonry portion of the home must equal at least 2/3 of the total area of the home, otherwise the home is rated as the other construction type (usually frame). In the case of 2 story homes, they are generally rated as “Frame” because the second story is typically built out of wood-framing and the area of the second floor takes up more than 1/3 of the total home’s area.

An alternative to masonry rated construction, a good alternative if you must build a wood-frame house, consider adding the necessary exterior finishing to qualify for “Masonry Veneer” construction. Masonry veneer is a construction type used for frame homes that have a veneer-type of finish. The outside can be finished with brick veneer, stone veneer, or a hardiboard veneer to qualify for this construction type rating.

A masonry home can cost about 30-35% less to insure than a frame home would cost.

Location – NEAR a Fire Hydrant but AWAY from a Flood Zone!

If have not yet purchased a lot of land to build your home on, a smart move is to consider where in relation to the nearest high-risk flood zone the lot of land sits. If the lot of land crosses over a high-risk flood zone then 2 things occur: (1) financing, and./or mortgaging the home will require flood insurance to be purchased and maintained; and (2) the rate for said flood insurance will be much higher than in non-high risk areas. We would also recommend purchasing building the home as far away from water sources and high-risk flood zones as possible - flood zones have a history of changing during periodic reviews conducted by FEMA. Just because your lot isn’t in a high-risk zone now does not mean it couldn’t be in the future if your local flood zone maps are revised.

In addition to flood concerns, there are also concerns with the risk of a fire occurring. Notably you want your home to be within 1,000 feet of a fire hydrant AND also within 5 road miles of a manned fire station. This combination receives the most favorable rate in terms of the fire portion of insurance coverage.

Finally the distance to the nearest coast line can play a large role in not only the rate quoted, but the availability of quotes in general. It is becoming far more common for an insurance carrier’s rating algorithm to rate homes singularly based on their distance to the nearest water source. As a result of this new form of rating, it’s not uncommon to see homes near one another see a large difference in the proposed rate simply because it’s a few hundred feet closer to the coast then the other home. Additionally, some carriers will not even offer a quote for consideration if the home is within 2,500 feet of the coast.

RELATED: Florida Governor Ron DeSantis sets dates for session on property insurance

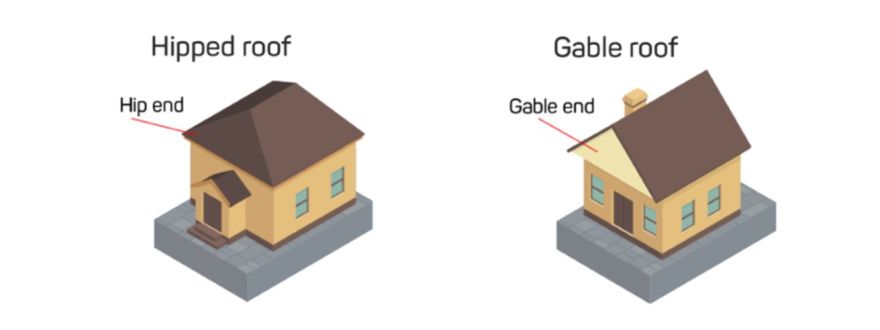

Roof Shape – Stay AWAY from Gables!

When picking a homes design, pay special attention to the shape of the roof. Mainly you want to avoid your roof having any gable features at all. You want your roof to be completely “Hip” shaped if possible. Hip shaped-roofs are capable of withstanding greater-force winds and therefor result in a lower rate than non-Hip shaped roofs (aka Gable roofs). If you are thinking about a roof style with any Gables, be aware that if the gable perimeter exceeds 10% of the total home’s perimeter, then your roof will be considered Gable and therefore have a higher rate.

Even if you decide to go with a design that includes Gable features, SAY NO TO ANY FLAT ROOFS that are designed to be over living area. The existence of any flat roofing on your home can mean reducing your coverage options (not every carrier will accept a roof with flat portions—regardless of age or size). Additionally flat roofs need replaced more often to stay insured with the few carriers who allow it. Just say no to a flat roof if you can.

We hope you found these tips helpful, and we also hope that you will reach out to us first when you need your next homeowners insurance quote! Remember, before you renew it, let us review it at Evolve Insurance Agency!

Thank You,

David Kronk Jr

Owner / Principal Agent, Evolve Insurance Agency