So now that we’ve talked about the low rate and sub-par coverage – let’s talk about the “Citizens Policyholder Surcharge”. When you purchase insurance coverage offered by Citizens Property Insurance Corporation (aka "Citizens"), you agree and acknowledge that there may be an additional surcharge billed to you in the event Citizens experiences a severe deficit in their claim reserves. For the purposes of these “built up reserves”, Citizens operates three accounts – Coastal, Personal Lines, and Commercial Lines – which are financially independent of one another and have separate claims-paying resources and capacities. A particularly devastating storm or series of smaller storms could exhaust these reserves, leaving Citizens without enough money to pay all claims. If this happens, Florida law requires that Citizens begin to charge assessments until any deficits are eliminated.

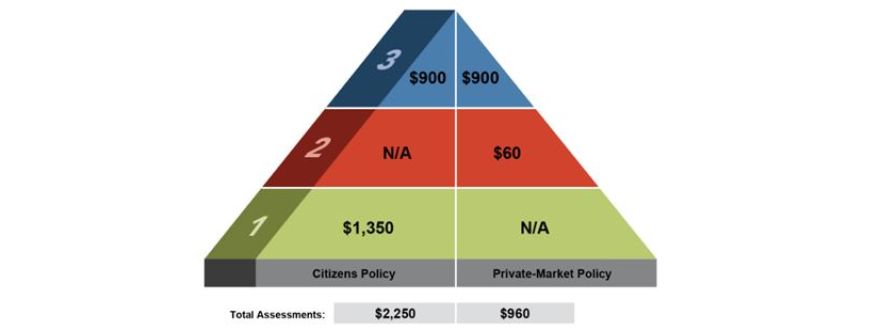

Assessments are charges that Citizens and non-Citizens policyholders can be required to pay, in addition to their regular policy premiums. Assessments are charged in three tiers, beginning with the Citizens Policyholder Surcharge. Each additional tier is charged only if the level before is insufficient to eliminate Citizens' deficit. Beyond that, the maximum of these surcharges can vary based on which of Citizens account(s) have experienced the deficit.

RELATED: Wave of Florida homeowners forced to use Citizens Insurance

Assessment Tier 1: Citizens Policyholder Surcharge

This is the first assessment that would be charged and is charged to Citizens policyholders only. A policy offered by a private market insurance would not be subjected to this surcharge. It’s billed as a one-time assessment and can be as high as 45% of the Citizens annual premium – up to 15% for each of Citizens’ accounts that experience a deficit.

Assessment Tier 2: Regular Assessment

This is the second assessment that would be initiated if Tier 1 was utilized fully but was not enough to cover the deficit. This assessment only applies to non-Citizens policyholders and is also billed as a one-time assessment. The benefit though is the maximum amount is 2% of your private insurer’s charged premium. This assessment could be applied to multiple lines of insurance including but not limited to homeowners, auto, and specialty and surplus lines policies.

Assessment Tier 3: Emergency Assessment

Assuming Tier 1 and Tier 2 are fully utilized and still not enough to cover the deficit, Tier 3 would be initiated. This assessment applies to both Citizens and non-Citizens policyholders and could be enacted for only one year or multiple years if necessary. The amount of the assessment charge could be as high as 30% - up to 10% for each of Citizens’ accounts that experience a deficit.

It’s also important to note that this does not include Citizens Emergency Assessments, which can be levied over multiple years at the same rate for both Citizens and non-Citizens policyholders, or additional mandated charges and assessments, such as the Florida Hurricane Catastrophe Fund (FHCF) and the Florida Insurance Guaranty Association (FIGA).

With Citizens growing at a rapid pace, the risk of an assessment being imposed is growing just as fast. On a year-over-year comparison, Citizens policycount is 45% higher than it was a year ago. This means much more property is being insured by Citizens, and therefor there is a greater potential of having a situation where Citizens does have a claims-paying deficit.

To make matters exponentially worse, Citizens is also struggling to complete it's full reinsurance purchase. Reinsurance is a type of insurance that smaller regional insurance carriers purchase to supplement their ability to pay claims. Currently Citizens has only acquired reinsurance coverage for about 35% of the risk they were hoping to insure. With less reinsurance coverage than expected and planned for, this also increases the potential of a surcharge as this puts even more of Citizens' reserves at risk.

Join us in Part 3 of our Citizens blog series when we talk about who's eligible for coverage with Citizens and how to apply for coverage.

David Kronk Jr

Owner, Evolve Insurance Agency